Renting your first apartment is a significant milestone, marking a step towards independence and self-reliance. However, navigating the financial landscape of renting can be daunting. This comprehensive guide, “How to Budget for Renting Your First Apartment,” provides essential information to help you prepare for the financial responsibilities of being a tenant. We’ll cover everything from understanding rental costs, creating a realistic budget, and exploring ways to save money, ensuring you’re financially prepared for this exciting new chapter.

From security deposits and monthly rent to utilities and moving expenses, this article offers a detailed breakdown of the costs associated with renting your first apartment. We’ll equip you with practical tips for budgeting effectively, managing expenses, and building a strong financial foundation. Whether you’re unsure how to calculate affordable rent or are looking for strategies to save for a down payment, this guide will empower you to confidently embark on your journey as a first-time renter.

Calculating Monthly Income and Expenses

Creating a realistic budget is crucial when considering renting your first apartment. This involves accurately calculating your monthly income and expenses.

Begin by determining your net income, which is the amount you receive after taxes and deductions. Consider all sources of income, including your primary job, any side hustles, or other regular payments.

Next, list all your monthly expenses. Categorize these expenses into essential (rent, utilities, groceries, transportation) and non-essential (entertainment, dining out, subscriptions). Be thorough and realistic in your estimations.

Setting Aside a Moving Fund

Moving into your first apartment involves more than just the first month’s rent. You’ll need a dedicated moving fund to cover various expenses. This fund acts as a financial safety net, ensuring a smooth transition into your new place.

Key expenses to consider include application fees, security deposits, and the often-overlooked cost of actually moving your belongings. Consider whether you’ll hire professional movers, rent a truck, or enlist the help of friends (and potentially provide food and refreshments).

Start saving early and consistently contribute to your moving fund. Even small amounts add up over time. Creating a realistic budget and sticking to it will help you avoid financial strain when moving day arrives.

Security Deposit and First Month’s Rent

Two significant upfront costs are the security deposit and first month’s rent. Landlords require a security deposit to cover potential damages to the property beyond normal wear and tear.

The amount of the security deposit can vary, often equal to one or two months’ rent. Be prepared to pay this lump sum when you sign the lease. Your first month’s rent is also due at lease signing.

Factor these costs into your initial budget. Saving in advance is crucial to avoid financial strain when securing your first apartment. Ensure you understand the terms of the lease agreement regarding the return of your security deposit upon moving out.

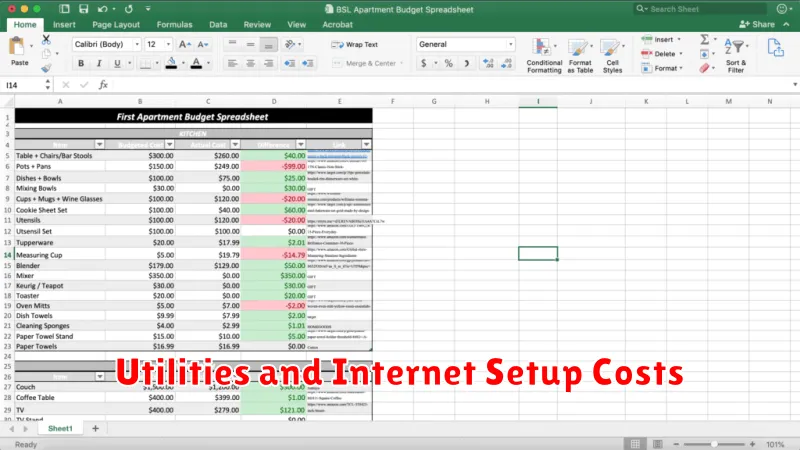

Utilities and Internet Setup Costs

Utility costs are a significant part of your monthly expenses. These typically include electricity, gas, water, and trash removal. The cost varies depending on your usage and location. Contact the utility companies directly for estimated costs in your area. Some apartments include some utilities in the rent, so clarify this with your landlord.

Setting up internet service often requires an installation fee and potentially equipment rental charges. Shop around for different providers and compare their prices and data limits to find the best plan for your needs. Factor in the cost of a router if you need to purchase one.

Furniture and Household Basics

Furnishing your first apartment can be a significant expense. Create a detailed list of essential furniture like a bed, sofa, and dining table. Consider budget-friendly options like secondhand furniture or renting certain items initially.

Beyond furniture, factor in essential household items. This includes kitchenware (pots, pans, utensils), cleaning supplies, and bathroom essentials (towels, shower curtain). Prioritize needs over wants to avoid overspending.

Emergency Fund Considerations

Prior to renting your first apartment, establishing an emergency fund is crucial. This fund acts as a safety net for unexpected expenses, preventing financial strain. Consider aiming for three to six months’ worth of essential living expenses.

Factor in your rent, utilities, groceries, transportation, and other recurring costs when calculating your target emergency fund amount. Having these funds readily available provides a buffer against unforeseen circumstances like job loss, medical emergencies, or necessary apartment repairs.

Planning for Rent Increases

Rent increases are a common occurrence, so it’s crucial to factor them into your long-term budgeting. Landlords often raise rent annually, sometimes by a significant percentage.

Research local rent trends and typical increase percentages in your area. This will help you estimate potential future rent hikes. Set aside a small amount each month in a dedicated savings account to cushion the impact of future rent increases.

When negotiating your initial lease, inquire about the landlord’s typical rent increase policy. While this isn’t a guarantee, it provides valuable insight into what to expect in the future.

Avoiding Overspending

Once you’ve established a budget, sticking to it is crucial. Overspending can quickly derail your finances, especially when starting out. Track your expenses diligently. Several apps and tools can help you monitor where your money is going. Be mindful of small, recurring expenses that can add up.

Resist impulse purchases. Before buying something, ask yourself if it’s a need or a want. Delaying gratification can help differentiate between genuine needs and fleeting desires. Setting a “cooling-off” period before making non-essential purchases can prevent buyer’s remorse.

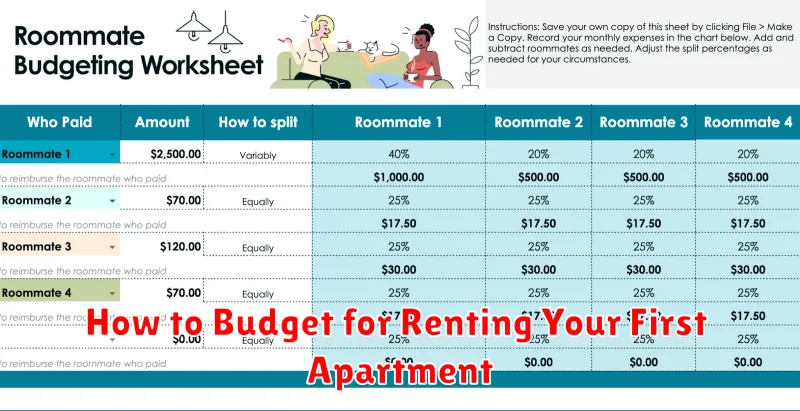

Using Budgeting Apps or Templates

Budgeting apps and templates can significantly simplify the process of creating and managing your budget. These tools often categorize expenses, track spending automatically, and provide visual representations of your finances.

Numerous budgeting apps are available for both Android and iOS devices, many of which offer free versions with robust features. Templates, available as spreadsheets or printable documents, offer a more hands-on approach and can be easily customized.

Whether you choose an app or a template, these tools help ensure you stay organized and aware of your spending, contributing to responsible financial management as you navigate renting your first apartment.

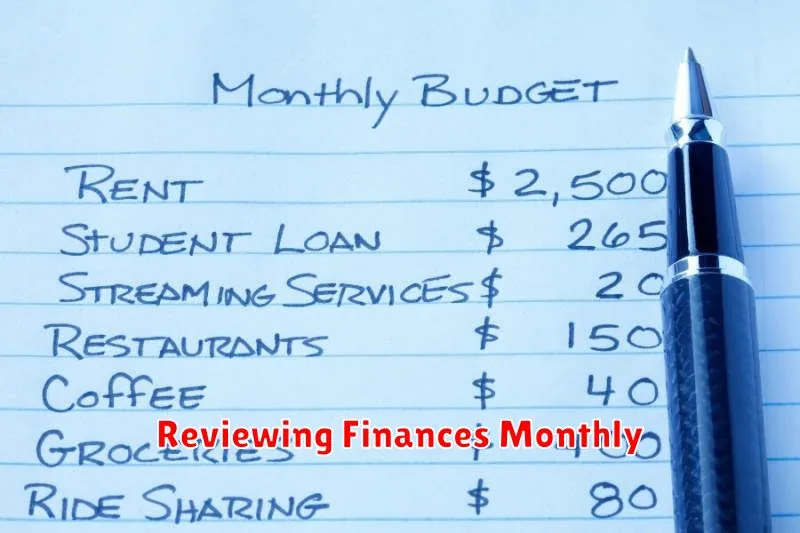

Reviewing Finances Monthly

Regularly reviewing your finances is crucial for successful budgeting, especially when renting your first apartment. This allows you to track your spending, identify potential issues, and adjust your budget as needed.

Key areas to review each month include your income, essential expenses (rent, utilities, groceries), discretionary spending (entertainment, dining out), and savings.

Compare your actual spending to your budgeted amounts. Are you consistently overspending in certain categories? If so, consider ways to reduce expenses or increase your income.