Navigating the complex world of real estate as a first-time homebuyer can feel overwhelming. From understanding mortgage rates and down payments to competing with other buyers in a competitive market, the process can be daunting. This guide offers invaluable advice and practical tips to help first-time homebuyers successfully navigate the housing market, empowering you to make informed decisions and achieve your dream of homeownership.

This comprehensive guide covers essential aspects of the home-buying process, including determining your budget, securing a mortgage pre-approval, understanding the intricacies of real estate transactions, and effectively competing in the current housing market. We’ll address common challenges faced by first-time buyers and provide strategies for overcoming them, ensuring a smooth and successful transition into homeownership. Whether you’re just starting your house hunt or are ready to make an offer, this guide will provide the knowledge and resources you need to confidently navigate the housing market.

Understanding the Local Market

Before diving into house hunting, it’s crucial to understand the dynamics of your local market. Factors like average home prices, property taxes, and inventory levels can significantly impact your purchasing power and the overall buying process.

Researching recent sales data in your target neighborhoods provides valuable insights into current market trends. Pay attention to how long homes are staying on the market. A fast-paced market often means higher competition and potentially higher prices.

Consulting with local real estate professionals can provide a deeper understanding of the nuances specific to your area. They can offer expertise on neighborhood characteristics, school districts, and future development plans.

Choosing Between New and Existing Homes

As a first-time homebuyer, one of your initial decisions will involve choosing between a new construction home and an existing property. Both options offer distinct advantages and disadvantages, requiring careful consideration of your priorities and budget.

New construction homes offer modern amenities, warranties, and energy efficiency. They require less immediate maintenance but often come with a higher price tag and potential construction delays. Location options may be more limited as well.

Existing homes typically offer more character, established neighborhoods, and potentially lower prices. However, they might require renovations or repairs, adding unforeseen costs. Negotiating price and competing with other buyers can also be challenging.

Budgeting for Hidden Costs

First-time homebuyers often focus on the down payment and mortgage, overlooking crucial hidden costs. Failing to account for these expenses can strain your finances and jeopardize your homeownership journey.

Beyond the sticker price, budget for closing costs, which include appraisal fees, loan origination fees, and title insurance. Property taxes and homeowner’s insurance are recurring expenses to factor into your monthly budget.

Don’t forget about potential moving expenses, immediate repairs, and the cost of new furniture or appliances. Setting aside a financial cushion for these unforeseen costs can provide peace of mind during the exciting, yet often stressful, transition into homeownership.

Getting Pre-Approved for a Mortgage

Getting pre-approved for a mortgage is a crucial first step in the home-buying process. It provides an estimate of how much you can borrow, giving you a realistic budget for your house hunt. This pre-approval also demonstrates your seriousness to sellers, making your offer more competitive.

The pre-approval process involves providing a lender with your financial information, such as income, assets, and debts. The lender then assesses your creditworthiness and determines the loan amount they are willing to offer. It’s important to shop around and compare offers from multiple lenders to ensure you secure the best possible terms.

Working with a Real Estate Agent

A real estate agent can be an invaluable asset during your home-buying journey. Their expertise in the local market, negotiation skills, and knowledge of the complex paperwork involved can save you time, stress, and potentially money.

When selecting an agent, look for experience, strong communication skills, and a good understanding of your needs and budget. Don’t hesitate to interview several agents before making a decision.

Your agent can assist with everything from finding suitable properties to negotiating offers and guiding you through the closing process. Clearly communicating your needs and expectations will help ensure a smooth and successful experience.

Negotiating the Purchase Price

Once you’ve found a property you’re interested in, the next step is negotiating the purchase price. This is where your real estate agent can be invaluable. They can help you determine a fair offer based on comparable sales (comps) in the area and the current market conditions.

Don’t be afraid to negotiate. While it’s important to be respectful, remember that the seller’s asking price isn’t always set in stone. Be prepared to walk away if you can’t reach an agreement that works for you.

Your offer should include the proposed purchase price, along with any contingencies, such as a satisfactory home inspection and appraisal.

Evaluating School Zones and Resale Value

For families, the quality of local schools is a critical factor. Research school districts and individual schools. Strong schools often correlate with higher property values and quicker resales.

Consider the long-term implications of your purchase. Even if you don’t have children now, residing within a desirable school zone can significantly impact your home’s resale value in the future. This is especially important in competitive markets.

Balance school quality with your budget. Homes in top-rated school districts often come with a premium price tag. Carefully weigh the importance of school zones against other factors like commute times and desired home features to make an informed decision.

Scheduling a Professional Inspection

Once your offer is accepted, the next crucial step is scheduling a professional home inspection. This inspection provides an in-depth assessment of the property’s condition.

Choose a licensed and reputable inspector. Your real estate agent can often provide recommendations. Don’t hesitate to ask about their experience and certifications.

Be present during the inspection. This allows you to ask questions and gain a firsthand understanding of any potential issues. The inspector will typically examine the roof, foundation, plumbing, electrical systems, HVAC, and appliances.

The inspector will provide a detailed written report outlining their findings. This report is a valuable tool for negotiating repairs or credits with the seller.

Securing Home Insurance

Home insurance is a crucial aspect of homeownership, protecting your investment from unforeseen events. As a first-time buyer, understanding this process is essential.

Start by researching different insurance providers and comparing quotes. Consider factors like coverage amounts for the structure, personal belongings, and liability. Also, factor in deductibles, which is the amount you pay out-of-pocket before your insurance kicks in.

Don’t forget about additional coverage options like flood insurance or earthquake insurance, especially if your property is located in a high-risk area. An insurance agent can help you determine the necessary coverage based on your specific needs and location.

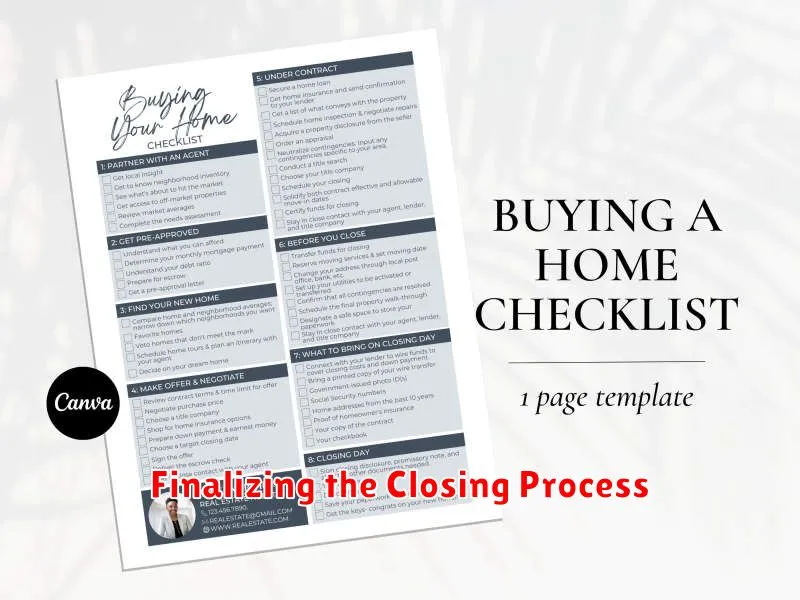

Finalizing the Closing Process

The closing process is the final stage of purchasing a home. It involves signing all necessary documents and transferring ownership from the seller to the buyer. This process can be complex, so it’s crucial to understand the key steps involved.

Final Walk-Through: Before closing, you’ll conduct a final walk-through of the property to ensure it’s in the agreed-upon condition. This is your last chance to identify any issues before officially taking ownership.

Closing Disclosure: Review the Closing Disclosure carefully. This document outlines all closing costs, loan terms, and other important details. Compare it to your Loan Estimate to verify accuracy.

Signing Documents: Be prepared to sign a significant number of documents at closing. These include the mortgage note, deed, and various other legal agreements. Ensure you understand everything before signing.

Fund Disbursement: Once all documents are signed, the funds are disbursed, and ownership is officially transferred. You’ll receive the keys to your new home!