Are you tired of renting and dreaming of finally owning your own home? Making the transition from renting to owning can be a significant step, but with careful planning and execution, it can be a rewarding experience. This comprehensive guide will provide you with valuable insights and practical advice on how to successfully navigate the process of becoming a homeowner. We’ll cover crucial aspects, including understanding your financial readiness, exploring mortgage options, and finding the perfect property to call your own. Learn how to make the leap from being a renter to a proud homeowner.

Transitioning from renting to owning requires a clear understanding of the financial implications and the real estate market. This guide will equip you with the knowledge necessary to confidently embark on this exciting journey. From assessing your credit score and saving for a down payment to negotiating offers and closing the deal, we will delve into every step of the home-buying process. Whether you are a first-time homebuyer or looking to upgrade from your current rental situation, this guide will provide you with the essential information and resources you need to successfully transition from renting to owning.

Evaluate Your Financial Readiness

Transitioning from renting to owning requires careful assessment of your financial standing. Budgeting is paramount. Track your income and expenses meticulously to understand where your money goes.

Credit score plays a vital role. A higher score unlocks better interest rates on mortgages. Check your credit report for errors and address any outstanding issues. Debt management is also crucial. High levels of debt can hinder your ability to secure a loan. Prioritize paying down debt, especially high-interest debts.

Saving for a down payment is a significant step. Determine how much you’ll need and establish a savings plan. Consider various down payment assistance programs if applicable.

Check Your Credit Score

Your credit score plays a crucial role in the home-buying process. Lenders use it to assess your creditworthiness and determine your eligibility for a mortgage. A higher score typically translates to better loan terms and lower interest rates, saving you significant money over the life of your loan.

You can obtain your credit report from the three major credit bureaus (Experian, Equifax, and TransUnion). Review your report for any inaccuracies and dispute any errors you find. Understanding your credit standing is the first step toward improving it if needed.

Determine How Much You Can Afford

One of the most crucial steps in transitioning from renting to owning is determining your budget. Affordability isn’t just about the listing price. It encompasses various expenses often overlooked by first-time buyers.

Start by calculating your debt-to-income ratio (DTI). Lenders use this to assess your borrowing capacity. A lower DTI signifies less financial risk. Next, consider the down payment. While 20% is traditional, lower options exist, often requiring mortgage insurance.

Finally, factor in recurring costs beyond the mortgage, such as property taxes, homeowner’s insurance, potential HOA fees, and maintenance expenses. Creating a realistic budget that includes these costs is crucial for a successful transition to homeownership.

Research First-Time Buyer Programs

Navigating the real estate market as a first-time homebuyer can feel overwhelming. Fortunately, numerous programs exist specifically designed to assist first-time buyers. These programs often offer benefits such as down payment assistance, reduced closing costs, and competitive interest rates.

Researching these programs is crucial. Start by exploring local and state government initiatives. Many housing authorities offer grants or loans tailored to first-time buyers within their jurisdictions. Additionally, investigate federal programs like FHA loans, which require lower down payments and more flexible credit qualifications.

Carefully compare program requirements and benefits. Consider factors like income limitations, property location restrictions, and required homebuyer education courses. Understanding these details will help you identify the programs best suited to your individual circumstances.

Compare Mortgage Options

Once you’ve been pre-approved, the next crucial step is comparing different mortgage options. Interest rates, loan terms, and fees vary significantly between lenders. Don’t settle for the first offer you receive.

Consider these common mortgage types:

- Fixed-Rate Mortgage: Offers a stable interest rate throughout the loan term.

- Adjustable-Rate Mortgage (ARM): Starts with a lower interest rate that can fluctuate over time.

- Federal Housing Administration (FHA) Loan: Government-backed loan with lower down payment requirements.

- Veterans Affairs (VA) Loan: Offers favorable terms to eligible veterans and service members.

Use a mortgage calculator to estimate monthly payments and total interest paid over the life of the loan for different scenarios. Carefully review all loan documents and ask questions before committing to a mortgage.

Start Saving for a Down Payment

Saving for a down payment is a crucial first step in transitioning from renting to owning. The down payment is the portion of the home’s purchase price you pay upfront. A larger down payment typically means a smaller mortgage and potentially better interest rates.

Determine how much you need to save. The minimum down payment can range from 3% to 20% of the home’s purchase price, depending on the loan type. For example, on a $300,000 home, a 20% down payment would be $60,000.

Create a realistic savings plan. Evaluate your current budget and identify areas where you can reduce spending. Set a savings goal and a timeline for reaching it. Consider automating regular transfers to a dedicated savings account.

Work with a Real Estate Agent

Engaging a real estate agent is a crucial step in the home-buying process. A buyer’s agent will represent your interests, providing expert guidance and navigating the complexities of the market.

Agents offer valuable services, including:

- Identifying suitable properties based on your needs and budget.

- Negotiating offers and facilitating the closing process.

- Providing market insights and advising on current trends.

Choosing the right agent is essential. Look for an agent with a proven track record, strong local market knowledge, and excellent communication skills.

Understand Closing Costs

Closing costs are expenses beyond the property price, paid at closing when you finalize the home purchase. These costs can be significant, typically ranging from 2% to 5% of the loan amount. Understanding these fees upfront is crucial for budgeting.

Common closing costs include lender fees (application, origination, appraisal), escrow fees (for property taxes and insurance), title insurance, recording fees, and transfer taxes. Prepaids, like homeowner’s insurance and prepaid interest, are also included in your closing costs.

You can request a loan estimate from your lender to get a detailed breakdown of anticipated closing costs. Review this document carefully. Don’t hesitate to ask your lender to clarify any fees you don’t understand.

Inspect the Property Carefully

Once you’ve found a potential property, a thorough inspection is crucial. Don’t solely rely on the seller’s description or online photos. Schedule a showing and examine every detail.

Look for any signs of damage, such as cracks in the foundation, water stains, or faulty wiring. Pay attention to the condition of the roof, plumbing, and HVAC system.

Consider hiring a professional inspector. They can identify potential problems that you might miss. A professional inspection can save you from costly repairs down the road.

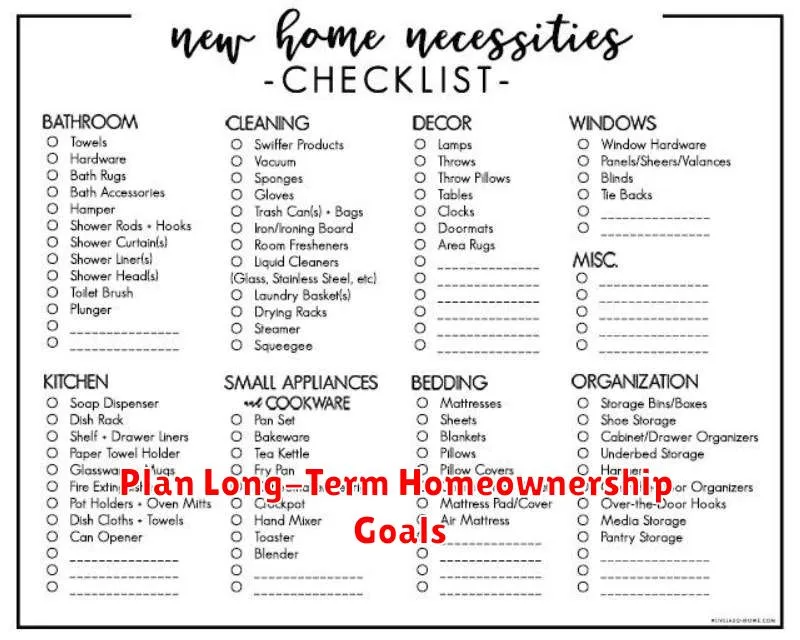

Plan Long-Term Homeownership Goals

Long-term planning is crucial for successful homeownership. Consider your future needs before committing to a property.

Think about how long you intend to stay in the home. Is this a starter home or a forever home? Your timeframe influences the type of property you should buy.

Also, consider your financial future. Do you anticipate significant changes in income or expenses? Factor potential job changes, family growth, or retirement into your long-term budget.

Planning for the long term minimizes financial stress and maximizes your investment.